Women’s Financial Wellness Workshop

FOR WOMEN OF ALL AGES

Mission

Our women’s financial wellness workshops are designed to bring the topic of money to the forefront of the conversation and empower you with the knowledge you need to create a financially-fit and successful lifestyle.

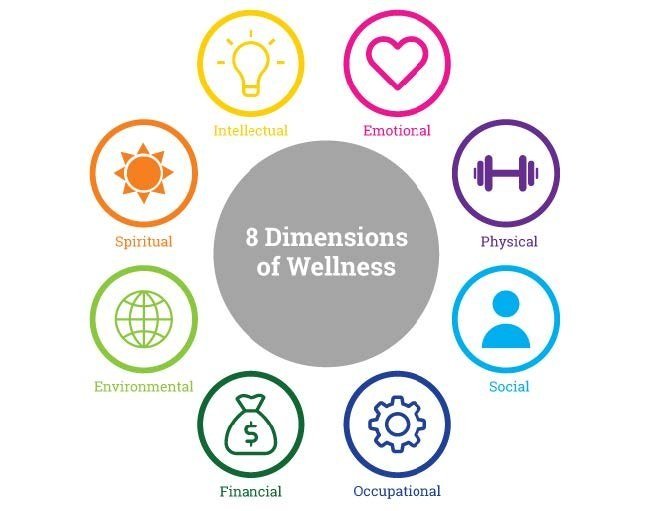

Holistic Approach to Personal Finance

Each aspect of your life plays a critical role in your health, well-being and overall quality of life. When just one aspect is ignored, it’s impossible to create a healthy and balanced lifestyle that positively impacts your mental, physical and emotional health. Taking a holistic approach to wellness allows you to ensure that each factor is positively influencing your choices, habits, lifestyle and overall quality of life. Our goal is to help you better understand the role that your financial life plays in this equation and how to improve the impact it has on your ability to create the life you want to live.

The Psychology of Money & Why It Matters

No one is entirely rational when it comes to money. We don’t follow a budget or spending plan when we know it’s in our best interest. We spend more than we can afford, out of recklessness, guilt or some other reason. As a result, our money behavior often causes shame, creating a vicious cycle of poor choices. In fact, about 49% of Americans are “concerned, anxious or fearful about their current financial well-being.” Money is something we all have a complex relationship with, and your personal finances aren’t a fixed entity – your money is a complex combination of numbers, challenges and opportunities you interact with and have feelings about. You make decisions about money that impact your financial situation – and in turn, affect your feelings and future behaviors. This relationship is something that has evolved over your entire life and will continue to evolve in the future. With the right tools and information, you can change what this relationship looks like and the impact it has on your overall well-being and quality of life.

What is Financial Wellness?

Financial Wellness is a constantly evolving state of well-being in which all aspects of your financial life are positively working together to maintain and improve your overall quality of life. It is not one destination; it’s a lifestyle – one that offers financial security and stability, freedom of choice, and the ability to live the life you want! What many people don’t realize is that achieving financial wellness and stability has nothing to do with how much money you make — it’s about spending and living within your means. It’s about understanding the financial decisions we face on a daily basis and having the knowledge to make informed choices.

Important Statistic: 19% of Americans have $0 saved to cover an emergency expenses; 40% have less than $400 in emergency savings.

Financial wellness allows you to create the following in your life:

Security means being able to cover day-to-day and month-to-month expenses without worry. It means having enough money coming in to cover all of your necessities, as well as the extra things you want.

Future security involves being able to cover emergency expenses, unanticipated bills and the future lifestyle you dream of.

Freedom of choice refers to being able to choose where you want to live, where to raise your children, what you want to eat and wear — all within reason. It means having enough money for more than just the absolute bare necessities. It means having the freedom to choose how you live your life.

Future freedom of choice means getting on track toward future financial goals like buying a home, sending a child to college or covering your retirement costs. It’s having a plan for the future and understanding how you can reach your goals in all aspects of life.

Your financial wellness has a direct impact on your health, well-being and overall quality of life.

• Achieving a state of financial wellness means that your financial life is positively impacting your overall quality of life, along with the other elements of well-being.

• Financial wellness involves understanding, maintaining and consistently working to improve each aspect of your financial life, including: budget/spending plan, savings, retirement fund, debt and other things specific to your life and your situation.

• Learning how to maximize your financial wellness not only reduces stress and improves your quality of life, but it also prepares you to handle potentially stressful financial situations in the future – along with the impact they have on your life.

The most important thing to remember is that achieving financial wellness doesn’t happen overnight — it’s a process that involves taking control over your financial life one step at a time — and learning how to manage the emotional and mental impact that your finances have on your life and overall well-being.

A Few Sample Questions & Topics Our Workshops Cover

Money & Emotions

• Identify the emotions you most often have around money — and how these emotional responses and attachments impact your spending and saving habits.

• Understanding the impact that these feelings have had on past financial decisions, inability to even make decisions and/or “mistakes” that you’ve been unable to forgive.

• Understanding how these emotions are holding you back when it comes to your financial life and your financial “success”?

• Identifying and confronting the things you are most afraid of when it comes to challenging, changing and/or improving your financial situation.

• Understanding how to start changing your emotional responses to money, in order to build a more successful relationship with your finances.

• Create a plan to address these issues and build a plan to start making changes today.

Understanding & Rewriting Your Money Story

Before you can get on the path toward achieving a positive state of financial wellness, you need to better understand how your relationship with money was formed and how it’s currently impacting your life. Think about the lens through which you see life – a lot of things have shaped the way you see and experience the world – your childhood, parents, family, friends, relationships, marriage, divorce, tv, movies, advertisements and other life experiences. These same experiences also impact your relationship with money and overall financial life and well-being. During childhood, you probably heard some version of “we can’t afford it” or “money doesn’t grow on trees” or “do you think I’m made of money?” Phrases like these, along with other experiences, have contributed to your money story and your mindset around the almighty dollar.

We will address the topics and questions related to the relationship that currently exists among your past, emotions, values and personal finances. A few examples include:

Your money story directly impacts how you view and use money in your life — your spending, saving, debt and more.

All of your life experiences up to this point have shaped your mindset around money and influence the decisions you make every day that impact your current financial status.

Only when you begin to recognize what your money story looks like — and tells you on a daily basis — can you begin to change the impact it has on your life, future and overall wellbeing.

We set aside time to identify and reshape your goals and values, which will allow you to modify your financial behavior in a way that aligns with the life you want to live.

We help you transform negative thoughts into more positive and empowering ones that allow you to achieve your goals.

Rewriting Your Money Story: Since your money story directly impacts your mindset, behaviors, decisions and overall wellbeing — learning how to rewrite this story will help you develop a more successful and

sustainable relationship with money. Rewriting your money story allows you to create a positive and consistent mindset around money that provides you with the freedom and confidence to create the life you want.

More Topic-Specific Workshops

Creating and sticking to a budget/spending plan

Debt

Reducing Debt

Credit

Savings

Banking Basics

Identity and Financial Protection

Student Loans

And more.